Deploys proven, bank-grade tokenization and encryption technologies for virtual assets

SUNNYVALE, Calif. & LAS VEGAS — (BUSINESS WIRE) — October 22, 2018 — Ushering in a new level of security for blockchain implementations, Rambus Inc. (NASDAQ: RMBS), today announced the availability of Vaultify Trade. The platform enables the secure storage and transfer of crypto and digital assets using proven, bank-grade, field-deployed tokenization and encryption technology. Vaultify Trade is the first product that enables banks, exchanges and investment portals to leverage tokens to secure the purchase, storage, exchange and sale of cryptocurrencies.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20181022005241/en/

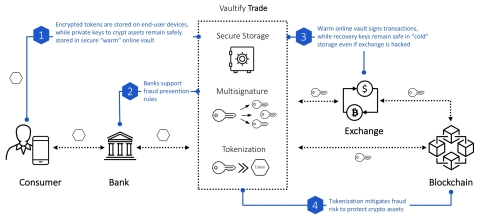

Vaultify Trade enables secure storage and transfer of digital assets using tokenization and encryption. (Graphic: Business Wire)

451 Research Director, Jordan McKee explains: “While cryptocurrencies represent significant opportunities, a major risk factor is that they are prone to theft, in large part due to the lack of strong security solutions for the blockchain. This undermines consumer confidence and limits the ability for financial services companies to offer products that help comply with regulations and best practices. With additional trust and transparency, the potential for cryptocurrencies to transform financial services can be realized.”

Blockchain is gaining increased traction across industries with the decentralized public-ledger framework opening new use cases daily, extending beyond cryptocurrency into financial services, retail, real estate, healthcare and insurance. While it provides a trusted and immutable record, the blockchain is not completely secure. Blockchain stores assets of value at an address in a public ledger using a private key. Much like a card or account number to access funds, that key is all that is required to access that digital asset, and if it is lost or stolen, that value is gone. Multi-signature enhances the level of security by introducing additional distributed keys for recovery and authentication of transactions, but still relies upon the use of original keys that are vulnerable to attack. Given the high-value financial and safety-critical nature of some proposed use cases, it is imperative that nothing alters data prior to its placement on the blockchain.

Tokenizing crypto assets and the blockchain

To meet this critical market gap, Rambus has created Vaultify Trade. Vaultify Trade combines multi-signature with proven, bank-grade tokenization technology to enhance security, confidentiality and privacy by replacing sensitive credentials—such as private keys for blockchain and crypto assets—with a non-sensitive equivalent token that is unique to each transaction. Unlike the private keys used to authorize blockchain transactions, tokens cannot be used by a third party to conduct transactions if intercepted. By replacing sensitive private keys with a limited use token that can include domain controls for device or channel, tokenization mitigates fraud risk and protects the underlying value of credentials. This reduces cryptocurrency security risks, which have led to enormous losses, adverse brand impact and suspensions of trading.

“Crypto assets are on the verge of going mainstream, but many of today’s consumers find cryptocurrency to be inaccessible and confusing, and are concerned by high-profile hacks. In order to accelerate adoption, consumers are seeking a secure, familiar way to access, trade, and own crypto assets through their trusted banking or trading apps,” said Jerome Nadel, GM of Payments and CMO, Rambus. “With over 100 billion transactions secured by Rambus technology, Vaultify Trade is a logical extension of our tokenization expertise. Banks, exchanges and investment houses can now quickly incorporate blockchain technologies into their product portfolios, armed with the confidence that data, value and assets are secure.”

Designed for virtual assets on the blockchain, Vaultify Trade features include:

- Tokenized Security – Replace sensitive private keys with domain-specific tokens to secure the transaction and storage of digital assets, limit vulnerabilities and improve trust.

- Multi-Signature – Multi-signature wallets require at least two signatures to confirm a transaction, increasing security and preventing fraud, while enabling faster transactions.

- Segregated Wallets – Combine the security benefits of an offline cold wallet with the convenience of an online wallet through multi-factor authenticated access to an online segregated wallet.

- White-label app and SDK – The Vaultify platform can support a white-label app or an SDK, allowing consumers to easily access and trade cryptocurrency through their usual mobile and desktop banking portals.

To learn more about how Vaultify Trade can help your organization, please visit www.rambus.com/vaultifytrade. Or, to see a demo of Vaultify Trade, please visit Rambus during Money 20/20 in Las Vegas at the Sands Expo Center in Booth #1349.

Follow Rambus: