ARLINGTON, Va. — (BUSINESS WIRE) — June 29, 2021 — AeroVironment, Inc. (NASDAQ: AVAV), a global leader in intelligent, multi-domain robotic systems, today reported financial results for its fourth quarter and full fiscal year ended April 30, 2021.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210629005997/en/

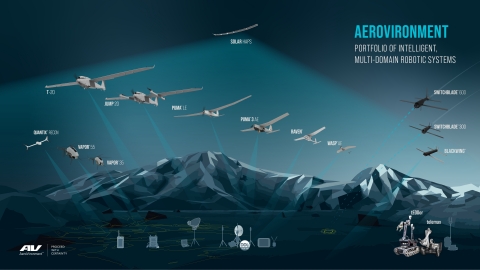

AeroVironment Offers a Portfolio of Intelligent, Multi-Domain Robotic Systems for Defense, Civil and Commercial Customers (Photo: Business Wire)

- Record fourth quarter and full fiscal year revenue of $136.0 million and $394.9 million

- Full fiscal year diluted EPS from continuing operations of $0.96 and non-GAAP diluted EPS from continuing operations of $2.10

- Record funded backlog of $211.8 million

- Closed two strategic acquisitions in the fourth quarter and a third in May 2021 that expand and enhance our product portfolio

“Our team again delivered record fourth quarter and full fiscal year 2021 revenue, representing a fourth consecutive year of profitable topline growth,” said Wahid Nawabi, AeroVironment president and chief executive officer. “In addition to producing solid financial and operational results despite the continued macroeconomic challenges our industry and economy are experiencing, we expanded our total addressable markets with the strategic acquisitions of Arcturus UAV, Progeny Systems ISG and Telerob. We continued our momentum over the course of the year securing a key initial contract for our new anti-armor Switchblade 600 loitering missile system, completing the fifth successful test flight of the Sunglider solar HAPS and demonstrating broadband LTE communication from the stratosphere. The AeroVironment team also made aviation history by developing critical propulsion and structural elements of the Ingenuity Mars Helicopter, the first aircraft to take flight in the atmosphere of another world.”

“We executed our growth strategy effectively in fiscal year 2021 and are well positioned to achieve significant revenue and adjusted EBITDA growth in fiscal year 2022 with our expanded team, geographic footprint and broad portfolio of intelligent, multi-domain robotic systems,” Mr. Nawabi added.

FISCAL 2021 FOURTH QUARTER RESULTS

Revenue for the fourth quarter of fiscal 2021 was $136.0 million, representing an increase from the fourth quarter of fiscal 2020 revenue of $135.2 million. The increase was due to an increase in revenue in our Medium Unmanned Aircraft Systems (MUAS) segment of $15.8 million resulting from our acquisition of Arcturus UAV in February 2021, partially offset by a decrease in revenue in our Unmanned Aircraft Systems (UAS) segment of $15.0 million. The decrease in UAS segment revenue was due to a decrease in service revenue of $14.2 million and a decrease in product sales of $0.8 million. Our UAS segment consists of our existing small UAS, tactical missile systems and HAPS product lines and the recently acquired Progeny Systems Corporation’s Intelligent Systems Group (“ISG”).

Gross margin for the fourth quarter of fiscal 2021 was $59.7 million, an increase of 12% from the fourth quarter of fiscal 2020 gross margin of $53.2 million. The increase in gross margin was primarily due to an increase in product margin of $8.8 million, partially offset by a decrease in service margin of $2.3 million. As a percentage of revenue, gross margin increased to 44% from 39%. The increase in gross margin percentage was primarily due to a favorable product and services mix. Cost of sales for the fourth quarter of fiscal 2021 included $2.6 million of intangible amortization expense and other related non-cash purchase accounting expenses as compared to $0.6 million in the fourth quarter of fiscal 2020.

Income from operations for the fourth quarter of fiscal 2021 was $17.8 million, a decrease of $3.5 million from the fourth quarter of fiscal 2020 income from continuing operations of $21.3 million. The decrease in income from operations was primarily a result of an increase in selling, general and administrative (“SG&A”) expense of $8.5 million and an increase in research and development (“R&D”) expense of $1.5 million, partially offset by an increase in gross margin of $6.5 million. The increase in SG&A expense for the fourth quarter of fiscal 2021 was primarily due to an increase in acquisition-related expenses of $3.3 million associated with the acquisitions of Arcturus UAV, ISG and Telerob GmbH (“Telerob”), and an increase in intangible amortization expense of $2.8 million.

Other expense, net, for the fourth quarter of fiscal 2021 was $9.4 million, as compared to other income, net of $1.2 million for the fourth quarter of fiscal 2020. The increase in other expense, net was primarily due to a legal accrual related to our former EES business, an increase in interest expense of $0.9 million resulting from the term debt issued concurrent with the acquisition of Arcturus UAV, and a decrease in interest income due to a combination of a decrease in the average interest rates earned on our investment portfolio and a decrease in the average investment balances.

(Benefit) provision for income taxes for the fourth quarter of fiscal 2021 was a benefit of $2.2 million, as compared to a provision of $2.6 million for the fourth quarter of fiscal 2020. The increase in benefit from income taxes was primarily due to the decrease in income before income taxes and an increase in certain federal income tax credits.

Equity method investment income (loss), net of tax, for the fourth quarter of fiscal 2021 was income of $0.4 million, as compared to loss of $2.1 million for the fourth quarter of fiscal 2020. The equity method income during the fourth quarter of fiscal 2021 resulted from our investment in a limited partnership fund.

Net income attributable to AeroVironment for the fourth quarter of fiscal 2021 was $10.9 million, as compared to $17.5 million for the fourth quarter of fiscal 2020. The fourth quarter of fiscal 2021 included a $9.3 million legal accrual related to our former EES business.

Earnings per diluted share from continuing operations attributable to AeroVironment for the fourth quarter of fiscal 2021 was $0.44, as compared to $0.73 for the fourth quarter of fiscal 2020.

Non-GAAP earnings per diluted share from continuing operations was $1.04 for the fourth quarter of fiscal 2021, as compared to $0.75 for the fourth quarter of fiscal 2020.

FISCAL 2021 FULL YEAR RESULTS

Revenue for fiscal 2021 was $394.9 million, an increase of 8% from fiscal 2020 revenue of $367.3 million. The increase in revenue was due to an increase in product sales of $22.1 million and an increase in service revenue of $5.5 million. Fiscal 2021 revenue in our UAS segment increased $11.8 million from fiscal 2020. Fiscal 2021 included revenue in our MUAS segment of $15.8 million resulting from our acquisition of Arcturus UAV in February 2021.

Gross margin for fiscal 2021 was $164.6 million, an increase of 7% from fiscal 2020 gross margin of $153.1 million. The increase in gross margin was primarily due to an increase in product margin of $11.5 million. As a percentage of revenue, gross margin of 42% was consistent with that of fiscal 2020. Cost of sales for fiscal 2021 included $4.5 million of intangible amortization expense and other related non-cash purchase accounting expenses as compared to $2.4 million for fiscal 2020.

Income from operations for fiscal 2021 was $43.3 million, a decrease of $3.8 million from fiscal 2020 income from operations of $47.1 million. The decrease in income from operations was primarily a result of an increase in SG&A expense of $8.0 million and an increase in R&D expense of $7.3 million, partially offset by an increase in gross margin of $11.5 million. The increase in SG&A expense for fiscal 2021 was primary due to an increase in acquisition-related expenses of $6.5 million associated with the acquisitions of Arcturus UAV, ISG and Telerob, and an increase in intangible amortization expense of $2.8 million.